EUR/GBP Price, News and Analysis:

- Will the EU and UK decide that a deal can be reached?

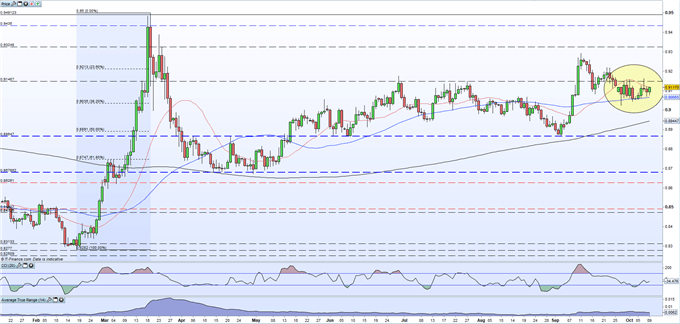

- EUR/GBP trapped in a narrowing range.

Crucial European Council Meeting Next Week

Trade negotiations between the EU and UK are set to dominate the headlines next week ahead of the two-day European Council meeting starting on Thursday. This meeting has always been seen as a make-or-break event to see if a trade deal can be reached with the UK, or if not then the focus will fully turn to the EU trading with the UK on WTO-terms from January 1, 2021. UK PM Boris Johnson has also said that he needs to know by October 15 if a deal is possible. This deadline, however, can still be broken, especially if there is a chance of a deal. EU chief negotiator Michel Barnier has already said that he will continue to negotiate until the end of October if a deal seems possible, while PM Johnson will not throw away the opportunity of a deal for a matter of a couple of weeks. The lead up to next week’s meeting will see increased news flow and narrative and Sterling’s volatility will rise in tandem.

Recommended by Nick Cawley

Download our Brand New Q4 Euro Forecast

EUR/GBP is currently trapped between 20-dma resistance and 50-dma support with both simple moving averages holding sway over the last two weeks. A recent series of lower highs were broken, just, on Wednesday, taking the edge out of the prevailing bearish sentiment and a break and close above the 20-dma should see 0.9155 to 0.9165 come back into play ahead of the 23.6% Fib retracement at 0.9213. A break below the 50-dma at 0.9066 opens the way to the 200-dma at 0.8948 and the 38.2% Fib retracement at 0.8891.

EUR/GBP Daily Price Chart (January – October 9, 2020)

| Change in | Longs | Shorts | OI |

| Daily | 24% | 3% | 13% |

| Weekly | 1% | -2% | 0% |

IG Retail trader datashows 45.87% of traders are net-long with the ratio of traders short to long at 1.18 to 1.The number of traders net-long is 2.73% lower than yesterday and 11.75% higher from last week, while the number of traders net-short is 8.35% lower than yesterday and 8.60% higher from last week.We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/GBP prices may continue to rise.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/GBP price trend may soon reverse lower despite the fact traders remain net-short.

What is your view on EUR/GBP – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.