USD/JPY ANALYSIS

Early this morning, the Japanese Yen (JPY) appreciated significantly against the US Dollar as stimulus hopes faded once more. The crucial relief package that has been the center of global markets of recent has diminished its pre-election potential on November 3. This comes after delayed negotiations over stimulus specifics.

The result has been a global risk-off mood as reflected in the shift towards the traditional safe-haven currencies (JPY and CHF). Upcoming elections will likely favour the Yen as volatility is expected to increase along with the rise in COVID-19 cases in Europe and the US. This being said, the uncertainty present around the aforementioned factors could limit Yen strength.

Visit the DailyFX Educational Center to discover why news events are Key to Forex Fundamental Analysis

USD/JPY TECHNICAL ANALYSIS

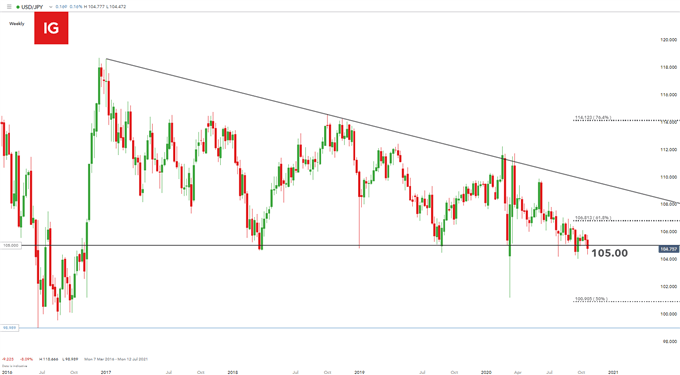

USD/JPY weekly chart:

Chart prepared by Warren Venketas, IG

The multi-year descending triangle (black) above shows price action testing lower support at the 105.00 psychological level. With fundamental tailwinds behind the Yen, further downside for the pair could take place over the next few weeks which will support the bearish continuation precept of the descending triangle pattern.

Starts in:

Live now:

Oct 26

( 11:10 GMT )

Keep up to date with price action setups!

FX Week Ahead: Strategy for Major Event Risk

USD/JPY daily chart:

Chart prepared by Warren Venketas, IG

The daily chart suggests USD/JPY approaching oversold territory (represented by the Relative Strength Index (RSI)) which could provide short term relief for bulls with 105.00 the near-term resistance target.

The 104.00 September swing low may likely see the next area of support for bears and consequently the 100.90 50% Fibonacci level should 104.00 not hold.

IMMINENT JAPANESE INFLATION FIGURES COULD INCITE BOJ INVOLVEMENT

The Bank of Japan (BOJ) has stated that they are keeping a close eye on the strengthening Yen and its potential impact on inflation. Bank of Japan Deputy Governor Masazumi Wakatabe has not taken further rate cuts off the table. The reasoning from the central bank is simply cost-benefit analysis whereby the benefits of further easing (if required) exceeds the cost.

Later today, the Japanese inflation rate for September (YoY) will be released at 23:30GMT. Inflation expectations by analysts are sustained pressure which could prompt BOJ intervention and measures regarding the appreciating Yen.

Recommended by Warren Venketas

Trading Forex News: The Strategy

USD/JPY: KEY POINTS TO CONSIDER MOVING FORWARD

The USD/JPY is largely at the mercy of global factors – primarily impending US elections. Clarity on the election should provide market participants with some directional bias going forward. The coronavirus is still a driving force behind Yen strength and will continue to do so until such time as a vaccine silver lining presents itself.

Key points to consider:

- 105.00 and 104.00 key horizontal levels

- Descending wedge pattern

- Expected rise in volatility

— Written by Warren Venketas for DailyFX.com

Contact and follow Warren on Twitter: @WVenketas